Inclusivity. Integrity. Service.

Banksmore Development Funds

Exceptional Real Estate Assets for your Portfolio

Two different real estate investment funds to meet your individual objectives.

Our goal is to help you add appreciating and cash flowing assets to your portfolio by investing in build-to-rent, multifamily housing developments and traditional value-add multifamily projects managed by our team.

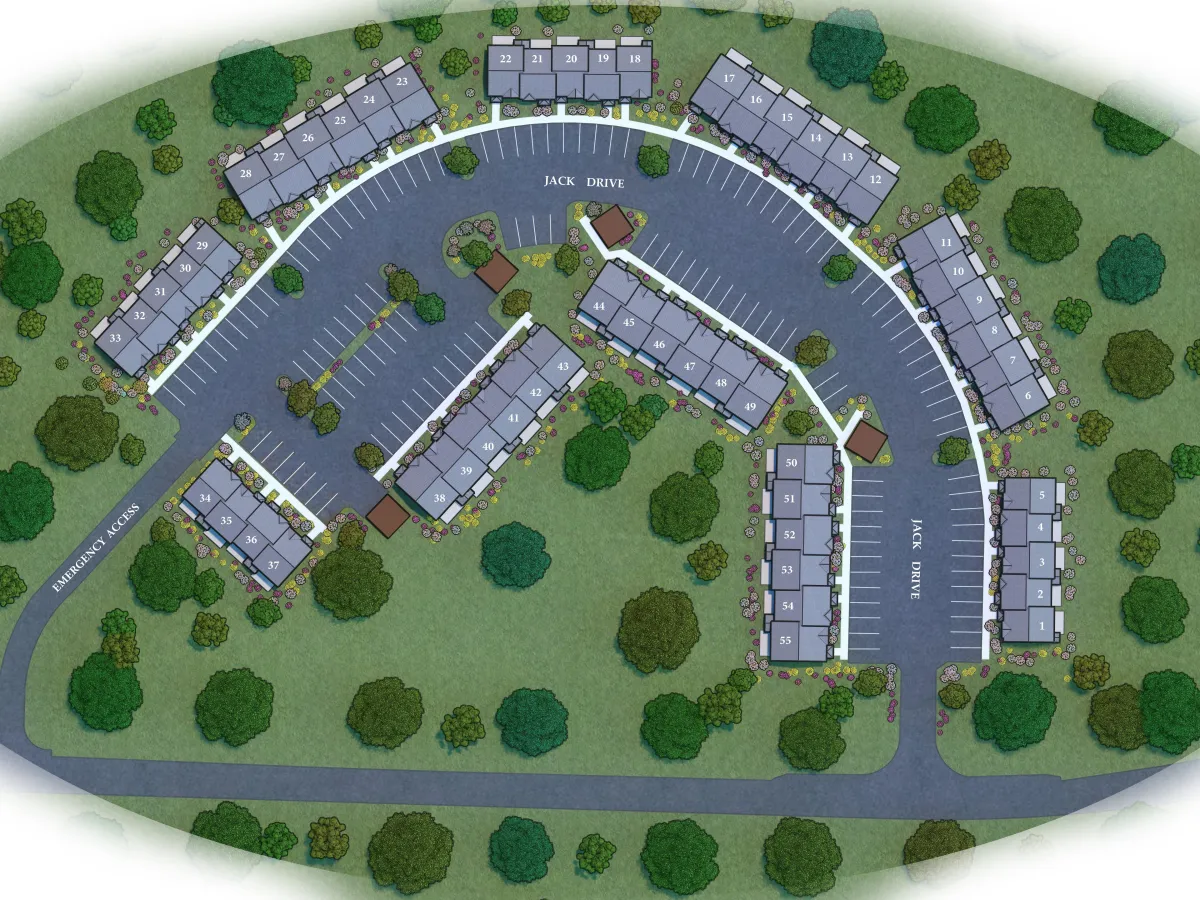

Banksmore Build-to-Rent ("BTR") Development Fund

Build-to-Rent "BTR" to us is defined as 150+ unit single-family and townhome subdivisions where all residents rent attached and detached residences. BTR communities offer the same scale and appreciation dynamics as traditional multifamily apartments, except they serve a larger population of renters and suffer from less resident turnover.

This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein.

The offering is made only by the private placement memorandum.

WHY INVESTMENT IN A

BTR FUND.

It follows an investment thesis backed by 50-year old trends in rising homeownership costs and stagnant wage growth.

One investment. Multiple large scale 150+ unit, build-to-rent housing developments.

Breakthrough asset class poised benefiting for a long runway.

The future of multifamily real estate investing is through build-to-rent housing product as preferences of renters have shifted.

Build-to-rent is America's solution to rising housing costs, homeownership might be out of reach in some areas of the country but quality of housing should not be.

WHY INVEST IN BUILD-TO-RENT COMMUNITIES.

Build-to-rent-communities provide positive investment returns and social impacts on small-to-middle market cities:

Strong fundaments supported by long-term a long-term housing shift.

Higher operating margins

Larger pool of possible renters (suitable for singles and families).

Significant housing demand and community acceptance

Long-term appreciation with new construction housing product

Lower turnover and vacancies with longer stays

A FRESHER STRATEGY OVER TRADITIONAL MULTIFAMILY

Our strategy provides investors with projected returns while simultaneously enhancing the communities in which we develop build-to-rent, multifamily projects.

ACQUIRE

The fund will not waste time on entitlements, it will only acquire only shovel-ready projects.

PRO-DEVELOPMENT COMMUNITIES

Leverage pre-development tax credit and cost savings leading to increased NOI on stabilization.

DEVELOP PROJECTS

Project manage all infrastructure development and vertical construction through extensive GC relationship across MD, PA, and OH.

STABILIZE DEVELOPMENTS IN PHASES

Complete staggered stabilization from 21 to 36 months from the beginning of construction.

REFINANCE OR SELL

Refinance the stabilized property and benefit from the spread on construction cost to cap rate and the exit cap rate.

RETURN OF CAPITAL

Refinance and sales proceeds will return initial capital and projected IRR to investors.

BUILD-TO-RENT COMMUNITIES PROVIDE SOCIETAL IMPACTS.

While our objective is monetary returns to our investors, significant positive societal impacts are created too

More affordable for tenants at or below median household income levels in targeted metropolitan cities

Fills need for more "livable" rentals and modern preferences.

Allows singles & families the ability to save in order to graduate into homeownership (based on housing spend to income)

Opportunities for communities to retain more residents over the long-term and improve overall neighborhood vitality

Developments are in areas with higher-quality schools compared to locations of aged multifamily apartments

OUR TEAM DOES ALL OF THE WORK.

Investors sit by and experience the growth from the AppFolio investor management platform, monthly project updates, and quarterly project webinars.

INCLUSIVITY. INTEGRITY. SERVICE.

We believe our offerings should be inclusive to all, be managed with the highest integrity, and provide the utmost service to our investors.

From a social impact perspective, our development projects are inclusive to all residents, are developed with integrity to municipalities & residents, and serve the communities in which we invest.

INVESTMENT FUND FEATURES

CONSTRUCTION: We construct build-to-rent communities at an 7-cap on stabilization to all-in development costs.

PROFITS: The Fund profits from the delta between cost-to-cap and the sales disposition cap rate (build, 7-cap; sell, 5.5-cap)

DIVERSIFICATION: The Fund will diversify in markets in the Mid-West & Mid-Atlantic and resident focus attainable, affordable, and affordable-luxury housing

TAX BENEFITS TO INVESTORS: New construction will create a higher cost segregation and accelerated depreciation basis that will be passed on to investors pro-rata as possible

LEVERAGE: The Fund will benefit from horizontal infrastructure and vertical construction leverage through sustainable capital stack leverage

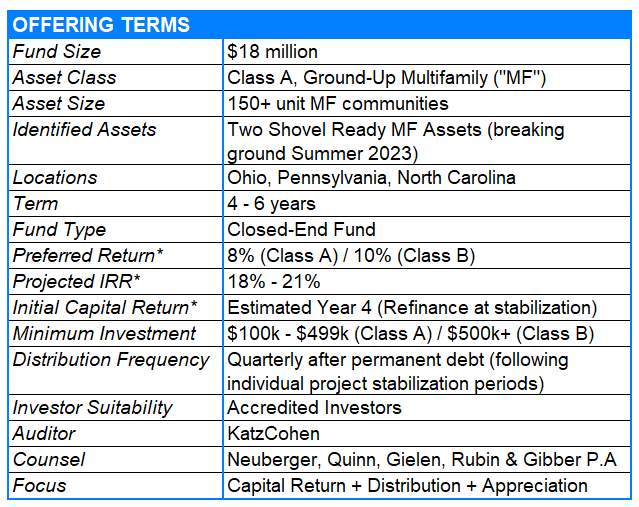

Banksmore Multifamily Development Fund I ("MDF1")

The Multifamily Development Fund 1 "MDF1" is defined as a 200+ unit ground-up, new construction fund which focuses on multifamily developments in Ohio and Pennsylvania. The MDF1 Fund invests as Co-General Partners alongside construction and property management general partners with new construction track records exceeding 2,000+ units.

This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein.

The offering is made only by the private placement memorandum.

At Banksmore, we are dedicated to transforming real estate investments by combining strategic development expertise with a focus on affordable luxury housing solutions that create lasting value for investors and communities alike.