Capital Flats Apartment Conversion

Investor Kit Access

506C Accredited Investors

Self-Directed IRA / 401K

Depreciation Passthrough

Capital Flats Apartment Conversion Investment Opportunity

An investment in Capital Flats is backed by robust fundamentals, supported by the highly favorable market conditions in the expanding area of Harrisburg, Pennsylvania.

Attractive 24 Month Partial Capital Return*

*Projected repayment of up to 65% investment returned within 24 months.

Have Questions?

Schedule a 1-on-1 advisory call with one of our partner relations directors.

Apartments Of Capital Flats In Paxtang

Expected Completion

November 2026

Hold Period

7 Years

Prime Location

3 Miles From Downtown Harrisburg

Transit Proximity

.5 Miles From Route 83

Under Supported Market

On average, 16 potential renters

compete for every available unit, which is

occupied within roughly 38 days.

High Demand

As of March 2023, Harrisburg leads the nation

as the #3 city for competition and demand,

with a 75.8% lease renewal rate.

Market Growth

Harrisburg's small rental market is one of the

most fiercely competitive in the United

States, with an RCI score of 127 at the peak

of rental season.

Project Returns

What To Expect

Average AR

20.9%

Investor IRR

20.3%

Proj. Equity Multiple

2.5X

Preferred RR

8.0%

Visual Experience

Of What's To Come At Capital Flats

At a Glance

Overview of Capital Flats

CAP

Total project capitalization of $11.5M.

Average build cost of $146k/unit.

Raise:

LP Capital $2.35M

GP Capital $260K

EXIT

Stabilization month is 24 mos. from start.

Exist anywhere between stabilization and seven years.

Market comps indicate exist of $187k/unit

LOCATION

Paxtang - Harrisburg, PA submarket has a median home value of $206k-$242K.

Neighborhood median income of $76K

Affluent And Educated Submarket

The Paxtang neighborhood has strong median income ($76k) and

incredible home appreciation (27.0% over two years), further

population growth (3 mi.) has been the highest in the nation over the

last 5 years at 6.55% (from 90,885 to 96,899).

Massive Rental Demand Drivers

Harrisburg remains very strong with a blended cap rate of 5.6% across

the metro, in comparison to larger markets with higher cap rates such

as Columbus, OH (5.9%) and Cincinnati (6.5%). Harrisburg is the most

competitive small rental market in the country, with 16 prospective

renters vying for the same apartment during peak rental season.

Exceptional Construction & Property Management Teams

The project’s construction managers have a robust track record in

central PA and are known to deliver on guaranteed maximum pricing.

Boyd Wilson is the property manager on a similar sized new

construction property owned by the GP’s principals and have an

outstanding reputation on Class A rental properties.

FAQ's

Frequently Asked About Capital Flats

Why should I invest in directly into a syndication?

Your participation in the Capital Flats Syndication offers you the opportunity to passively invest in a market-rate development deal without the initial land development risk. Banksmore acquired the 80,000 SF free standing building in May 2024 with all of the infrastructure complete. The business plan calls for interior demolition and renovation of the existing four-story building, which is expected to significantly decrease the total construction and stabilization period timelines.

What are my anticipated returns as a Limited Partner in the Syndication?

As an investor you will earn a preferred return of 8% per annum, plus additional cash consideration through quarterly distributions, a refinance event, and a sale event with a partial return of initial investment expected in around the two-year mark. Current projections anticipate returning 65% of initial investment capital to LP investors.

The Syndication projects average annual returns of 20.9% per year over seven years or 20.3% internal rate of return. The anticipated equity multiple with a seven-year hold is 2.5x initial capital invested. (Note: all returns are estimated, and the conditions and risks of the Private Placement Memorandum should be reviewed prior to investing.)

How do you benefit from investing in this Syndication?

An investment in a quality, Class A re-development inherently has more appreciation upside than a classic value-add investment (for example, build at $147,000 per unit and sell at $180,000-$190,000 a unit).

There is very little new construction in the Harrisburg PA market, so it is expected the Capital Flats asset will be desirable to renters and also investors once the project is sold.

As higher interest rates have pummeled free cash flow after debt service on classic acquisition multifamily investments, full-scale renovation and redevelopment is a solid investing alternative to reap capital appreciation.

Does Banksmore already own the property?

The Banksmore partners privately funded and completed the acquisition at 3607 Derry St on May 14, 2024. Now with demolition expected to start late summer and construction in the months that follow, the partners are raising a total of $2.6 million investment capital to fund construction alongside a construction loan.

How can I get started with a possible investment?

1. The process for registering for the Syndication will take place within the Banksmore Investor Portal powered by Appfolio. Link to Banksmore Investor Portal

2. Once the registration link is available, login to the portal or create an account if you are a new investor with us.

3. Follow the prompts to fill in your investment information and electronically sign documents. As an investor, you will need to sign the subscription agreement and the operating agreement joining you and your investment to Capital Flats MFI LLC.

4. Once your spot is confirmed the next steps will be to verify your accredited status (guidelines are in the portal).

5. Upon completion of verification, the wire instructions will be supplied securely within the portal.

If you need help with filling out documents or with your investor portal account, please email:

investors@banksmore.com

What are the steps to invest in Capital Flats?

1. Login to your existing Banksmore investor portal account or sign up for a new account here: Link to Banksmore Investor Portal

2. Click “Invest” on the top right page to register in the portal. Clicking “Invest” does not mean you are required to invest in the Syndication, but rather grants you access to more information.

3. Select your investment profile

4. Have your 3rd party Accreditation letter ready for uploading to the portal after your spot is confirmed; and

5. Finally, fund your committed amount - wire instructions will be provided within the portal after accreditation confirmation is completed.

What are the investment classes and what is the required minimum?

For this Syndication there is only one investment class, Class A with one preferred return of 8% accruing to limited partner investors.

Class A is designed for individuals who seek to maximize their returns over the investment's entire lifespan, as they will have the opportunity to share in any potential profits upon the investment's disposal. Class A investors also earn a split of all cash, refinance, and sale proceeds at the project-level, which follow the internal rate of return (IRR) waterfall structure below:

Class A: Min Investment $150k – 8.0% preferred, plus equity upside

Please note all investors will be accepted on a first-come, first-serve basis according to the timestamp of their e-signed documents in the investment portal.

What is the Investment’s targeted returns?

If you assume a seven-year hold for investment as a Class A Limited Partners, the targets below are indicative of construction, refinance and disposition performance in the project.

Internal Rate of Returns (IRR): 20.3%

Average Annualized Return (AAR): 20.9%

Equity Multiple (EM): 2.5x

How does the preferred return work?

The preferred return is calculated from the time of initial investment as capital is deployed, which occurs August 2024 in this Syndication. During the construction phase and stabilization period of the projects, your preferred return will accrue to be paid or caught up during a possible refinance, when cash flow begins to tip on stabilization, or there is a sales transaction.

Will I receive any tax benefits from this investment?

The general partners will complete a cost segregation depreciation study in order to equitably pass depreciation benefits back to investors once the property is in use. It is expected investors may have significant depreciation passthrough benefits in 2025 when the property is placed into active use. The IRS does not allow investors to depreciate a vacant building and although we will be under construction in 2024, we will not be leasing units to leaseholders yet. The general partners are not tax professionals, so please consult your own professionals with regards to taxes.

What documentation will I receive at tax time?

The general partners will provide K-1s to all investors by March 15th of each year, so Limited Partners can provide appropriate IRS documentation to their accountants.

What is the cadence of reporting I can expect if I invest?

During the construction phase, monthly reports will be given on progress and completion percentage on the scope of work along with pictures and videos. Investors will be welcomed periodically to the site at 3607 Derry St to review progress in person and talk with members of the construction team. During lease up and the stabilization period, there will be updates given on marketing progress and lease-up progress by our property management company and then there will also be monthly financial reporting.

On a quarterly basis, the partners of Banksmore will host a webinar and chat for investors to get updates and ask questions.

How will distributions occur?

All distributions of proceeds resulting from a capital event will be distributed in accordance with the procedures outlined in the private placement memorandum and operating agreement. Since distributions occur once the Capital Flats asset reaches a milestone, investors can expect to receive their share of proceeds from the project when they occur throughout the investment term.

How much time do I have to decide on the Syndication?

The partners may close the fundraising at any time. Please use your discretion and if you are committed to partnering with us, please share your intentions by subscribing and making a commitment.

Do the General Partners have ownership over real estate?

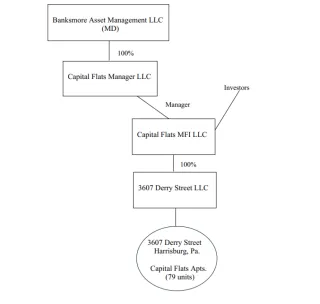

No, the General Partners and Limited Partner Investors share ownership in the same entity (Capital Flats MFI LLC) that in turns owns the real estate entity (3607 Derry St LLC). The General Partners are listed as Class B shareholders will Limited Partners hold Class A shares.

How long will be initial capital be held in the Syndication?

Based on the current timeline of construction (12 to 15 months), the project may be stabilized in as little as 24 months. Stabilization means achieving 90% in occupancy and then being able to refinance the project into long-term debt. Once the above construction and stabilization milestones are hit, the goal is to distribute a minimum of 65% of initial capital back to investors. This refinance event could return a significant portion of investor capital back early in the life of the Syndication.

How much will the General Partners invest in the project?

The Sponsors intend to invest between $260,000 and $500,000 in Class B shares as required by the bank. Additionally, the partners of Banksmore are guaranteeing $9.0 million in construction debt whereas the Limited Partners do not have to guarantee anything.

What is my liability as an investor?

As a Limited Partner (LP) in the Syndication, your liability is typically limited to the amount of your investment in the fund. Your personal assets are protected from any losses or legal claims related to the Capital Flats investment. The General Partner (GP) is responsible for any debts, obligations, or legal claims that arise from the fund's activities.

What is the entity structure of this investment?

Investors in the Capital Flats syndication will be investing in Capital Flats MFI LLC which is the direct owner of 3607 Derry St LLC, the real estate owned entity for the project. The Capital Flats MFI LLC will be managed by the Banksmore management team through their management entity known as Capital Flats Manager LLC.

This offering memorandum is being provided on a confidential basis solely for theinformation of those persons to whom it is given. The materials, including the information contained herein, may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of Banksmore. By accepting this offering memorandum, you agree that you will comply with these confidentiality restrictions and acknowledge that your compliance is a material inducement to our providing this brochure to you.

A ny targeted returns, projections or other estimates in this investment summary, including estimates of refinancing proceeds, returns or performance, are forward-looking statements and are based upon assumptions.

The sponsorship believes there is a sound basis for achieving any targeted returns contained herein; however, other events, which may not have been taken into account, may occur and may significantly affect the outcome. Any assumptions should not be construed to be indicative of the actual events that will occur. Actual events are difficult to predict and may depend upon factors that are beyond the control of the Company and the Sponsor. Certain assumptions havebeen made to simplify the presentation and, accordingly, actual results may differ, and may differ significantly, from those presented herein.

At Banksmore, we are dedicated to transforming real estate investments by combining strategic development expertise with a focus on affordable luxury housing solutions that create lasting value for investors and communities alike.